RSI Trading Strategy: Master RSI Indicator for Momentum Exhaustion

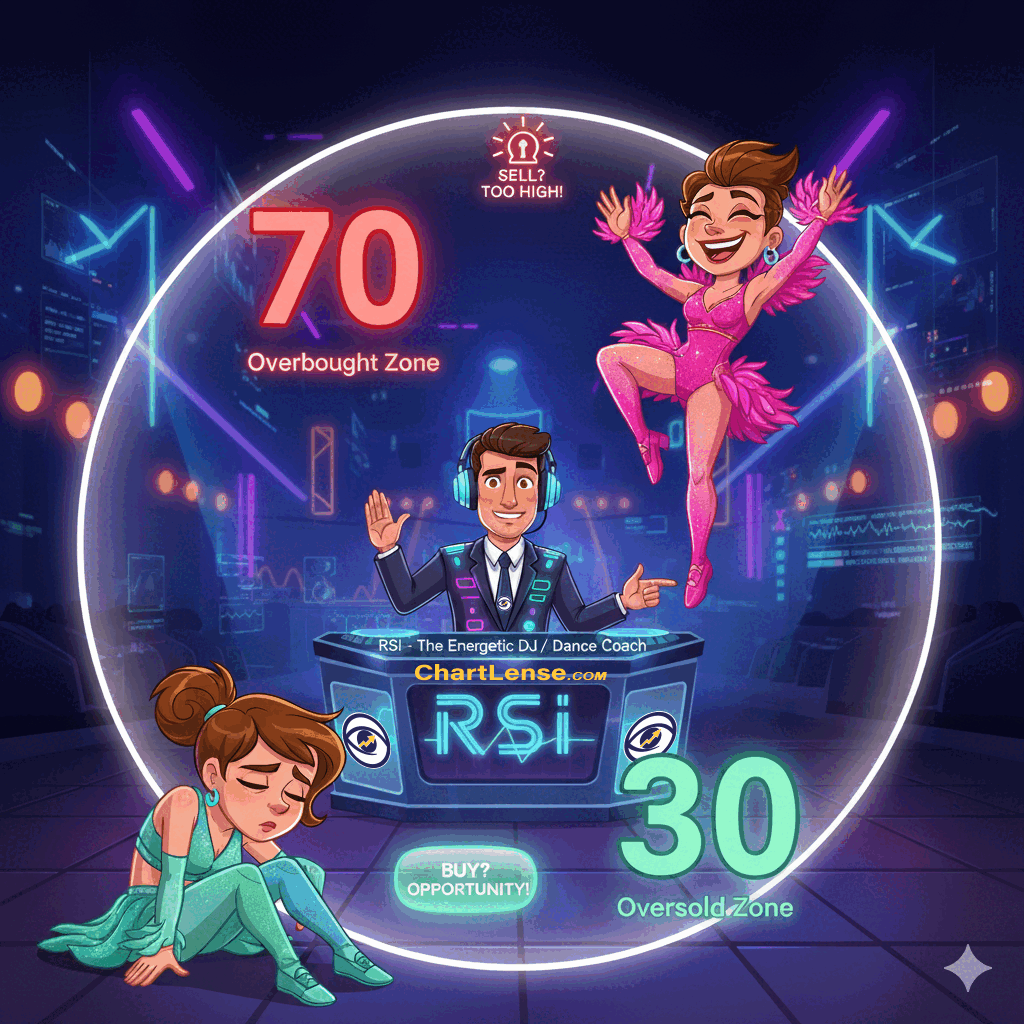

Learn how to use the RSI indicator to spot exhausted trends, identify overbought and oversold conditions, and catch reversals before they happen. This comprehensive guide teaches you the Relative Strength Index (RSI) - a powerful momentum oscillator that measures when buying or selling pressure is running out of steam. Master overbought zones (70-100) and oversold zones (0-30) for reversal warnings, understand divergence patterns that predict trend changes, and integrate RSI with support/resistance levels. Perfect for beginners with the engaging Stadium Energy Meter video, interactive zone charts, and actionable trading strategies.

🏟️ Welcome to The Trading Stadium

Picture this: You're standing in the world's most advanced trading stadium. On the massive jumbotron above, there's a giant Energy Meter that measures the crowd's excitement level from 0 to 100.

When the crowd gets too hyped (above 70), security guards start watching closely - someone's about to collapse from exhaustion.

When the crowd is completely drained (below 30), the energy crew prepares for the inevitable comeback surge.

This energy meter? It's the RSI (Relative Strength Index) - and it's about to become your secret weapon for spotting exhausted trends before they reverse...

Watch the Stadium Energy Meter in action - spotting momentum exhaustion in

real-time

🎯 The Energy Meter in Action

The stadium energy meter has two critical zones that every trader must understand. Click through the interactive zones below to see how the RSI moves through different market conditions:

How to Read The Zones

The RSI line moves between 0 and 100, but the most important areas are the "zones." Click the buttons below to see what each zone means and how the RSI line looks within it.

Neutral (30-70)

This is the normal operating range. The 50-line is the halfway point. If the RSI is staying above 50, it can show the asset has generally positive momentum (an uptrend).

Quick Zone Summary:

TOO MUCH BUYING ENERGY - Crowd is exhausted from celebrating

Warning: Buyers may collapse soon → Potential reversal down

TOO MUCH SELLING PRESSURE - Crowd is exhausted from panic

Watch for rebound: Sellers may exhaust soon → Potential reversal up

RSI doesn't tell you trend direction - it tells you when a trend is EXHAUSTED

Exhaustion comes before reversal

📈 RSI in the Real Trading World

The stadium announcer points to the big screen: "Want to see the Energy Meter catch a reversal before it happens? Check this out..."

RSI hitting overbought territory (70+), warning of exhaustion before the price reversal

RSI hitting overbought territory (70+), warning of exhaustion before the price reversal

🎬 Behind the Scenes at The Stadium

The stadium engineer pulls you aside: "Want to know the technical specs of our energy meter? Here's what makes it tick..."

What RSI Really Means

Relative Strength Index - fancy name for measuring momentum exhaustion. The stadium's founder built this energy meter to track one simple thing: are buyers or sellers running out of steam?

RSI compares the average gains vs average losses over the last 14 periods (typically 14 days):

RSI = 100 - (100 / (1 + RS))

where RS = Average Gain / Average Loss

Translation: If buyers are winning more battles than sellers, RSI goes up. If sellers are dominating, RSI goes down.

Average gains > Average losses

RSI moves toward 100 (pure buying strength)

Average losses > Average gains

RSI moves toward 0 (pure selling pressure)

The Stadium Engineer's Equipment

Why 14 periods? It's the Goldilocks setting:

- Too short (7 periods): Too sensitive, false signals

- Too long (28 periods): Too slow, misses opportunities

- Just right (14 periods): Balanced sensitivity and reliability

The Two Critical Zones: Overbought (70-100) and Oversold (0-30) - simple thresholds that work because everyone watches them.

Integration Wisdom: "RSI is like having a great scout - helpful on its own, but unstoppable when working with the team. Always check what your other Academy tools are telling you."

🎭 The Plot Twist: When The Meter Lies

The stadium analyst taps your shoulder: "Here's the advanced secret - sometimes the energy meter shows something the scoreboard doesn't..."

RSI Divergence: The Hidden Truth

Bearish Divergence (Warning: Trend Exhaustion)

- Price: Making higher highs (celebrating)

- RSI: Making lower highs (energy declining)

- Translation: "The celebration is getting weaker each time - exhaustion incoming"

Bullish Divergence (Warning: Reversal Coming)

- Price: Making lower lows (panic deepening)

- RSI: Making higher lows (panic weakening)

- Translation: "The panic is getting less intense - bounce incoming"

Advanced Wisdom: "Divergence is like having inside information. The energy meter reveals the truth before the price action catches on. When price and momentum disagree, momentum usually wins the argument."

⚠️ Common Mistakes & Key Takeaways

Before you start trading with RSI, learn from the mistakes that trap beginners:

❌ DON'Ts: Common Mistakes to Avoid

✖

Trading Every Signal

Do not sell just because RSI is > 70 or buy just because < 30. This is the #1 mistake. It's a warning, not a command.

✖

Using RSI Alone

The RSI is a supporting tool. It works best when you combine it with other analysis, like support & resistance levels or moving averages.

✖

Ignoring the Main Trend

Don't try to "catch a falling knife." In a strong downtrend, RSI can stay oversold for a long time. Don't fight the dominant trend.

✓ DOs: Key Takeaways

✔

Use it as a Speedometer

Remember, RSI is not a crystal ball. It just tells you if the market's recent move is "hot" or "cold." Think momentum measurement, not price prediction.

✔

Look for Divergence

Divergence (when price and RSI disagree) is generally a more reliable signal than just overbought/oversold levels. This is where RSI shows its real power.

✔

Use it for Confirmation

Use the RSI to confirm what you see on the price chart. If you see a bullish price pattern AND a bullish RSI divergence, that's a much stronger signal.

Ready to Spot Exhausted Trends?

📚 Related Lessons

Continue your trading education with these complementary lessons:

MACD Basics

Combine RSI exhaustion with MACD momentum for powerful confluences

Volume Analysis

Use volume to confirm RSI overbought/oversold signals

📖 Dive Deeper with TradingView

Want to master the Stadium Energy Meter? Check our support section for help.